President Obama has now announced his decisions on a new incentive to combat his perception of the future as it sits threatened by the increased carbon dioxide produced by the burning of fossil fuels, particularly coal. As announced by the EPA, the Clean Power Plan “will maintain an affordable, reliable energy system, while cutting pollution and protecting our health and environment.”

The proposed rule has the intent of lowering carbon dioxide emissions by 30% from the levels of 2005, by 2030. As with many energy-related plans this one will take some time to implement, particularly since individual states have some input to the final program that will be put in place. More to the point, it will influence the thinking of power generators and legislators over the next few years.

Beyond the actual implementation, the real impact will be in the planning departments of the utility companies around the country. There is at least an even chance that, at some time in the future, these will become the regulations that must be followed, and as future power plant construction is planned, so the options that will be considered will now be changed to accommodate these likely regulations.

Realistically the closure of coal-fired plants will likely be followed by the construction of more natural gas plants, since the overall electrical energy needs of the country are unlikely to fall significantly. In the short term this is unlikely to be a problem. However as one moves into the intermediate term (say more than 5 years out) the old plants will have gone, and the country will become increasingly dependent on natural gas, in the same way as Europe is at present. As the old coal plants are demolished, they, and the coal mines that supply them, cannot be resurrected within a five-year period given the amount of permitting, financing and overall planning that is now required for such construction.

Natural gas has advantages over coal, in that it can be supplied by pipeline that makes it less susceptible to weather. But by the same token it is rarely stored on site, but metered along the pipeline as demand rises and falls. As history has shown, this can lead to critical shortages when, at times of high demand, the pipeline cannot keep up with demand.

At present the likelihood of problems seems remote, wells continue to be sunk and production in increasing in fields around the country. But if one goes beyond the picture that is projected as reassurance to those concerned for energy supply in the future the numbers revealed are not that comforting.

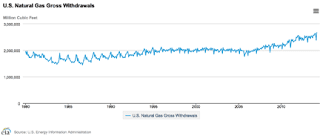

Figure 1. The changing picture of natural gas demand (EIA)

One begins with the prediction that the US has about 100 years of natural gas supply with a total extractable volume in reserves and resources of over 2,718 Tcf. It is a reassuring number but, as with the total volumes of either oil or coal in the ground, it does not really give that much information on what will be available as demand continues to rise.

Consider that, increasingly, the volumes of natural gas that are being sought are in shales, where the well must turn and drill along the shale horizon, before being fracked to produce gas and oil within the rock.

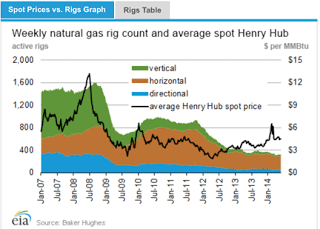

Figure 2. Number of rigs defined by type of well (Baker Hughes via EIA and Penn Energy)

The increasing dominance of horizontal well completions brings with it a considerable increase in well costs. You can see this as the technique became of increasing importance after 2005.

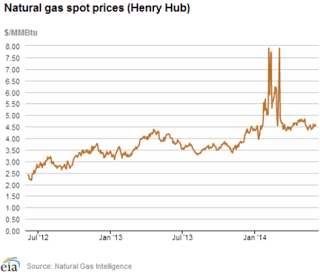

Figure 3. Change in the average cost of natural gas wells (EIA )

Well construction prices have continued to rise since that time, with numbers now running up to and beyond $ 10 million. The rising costs makes it harder to achieve a reasonable return on that investment, particularly as there has been no great increase in the overall price of natural gas to reflect its increased popularity, in large part because of the rush to drill and produce the known reserves.

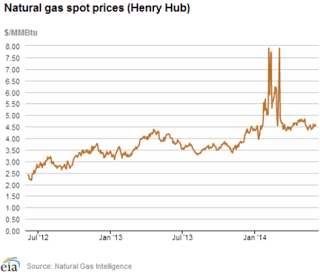

Figure 4. Recent changes in natural gas prices (EIA )

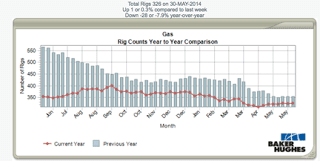

As a result the number of rigs working in the natural gas fields has fallen, to the lowest levels of the recent past.

Figure 5. Change in the natural gas rig count over the past year. (Baker Hughes )

If you can’t make a profit on the merchandise, then after a while you stop trying to produce it. Despite the optimism that leads folk to anticipate large volumes of low-priced natural gas being able to sustain us into the foreseeable future if the companies cannot make a profit, after a while they stop. Which means that prices will go up, re-opening the cycle, but on a higher step. In time this will bring natural gas prices back up to around $ 8.00 per tcf, which will make the industry more comfortable.

What it will not do, however, will be to favorably impact the economics of the electricity business, where doubling the cost of fuel has a quite negative effect on prices and overall economics. But concerns over the rising price to be paid has had little impact yet on political decisions on energy in Europe, and one has to presume that a similar blindness to energy price consequences will also prevail in the United States. After all there is lots of natural gas around, it just has to be perceived as remaining a cheap fuel to validate the political plans . . .right ??!!