Further, given the time that is required to find new fields, develop them and then connect into a distribution network that carries the oil to refineries and the customer, without the knowledge of what is going to be needed, the crisis of under supply will approach not only more rapidly but also with less flexibility in being able to remediate the shortages when they start developing.

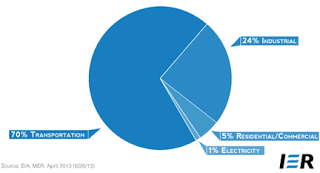

A large part of the problem lies in the way that oil is used. With much of it being refined into transportation fuels – in the USA some 70% – there is little in the short run that can be used to replace it.

Figure 1. Percentage uses of petroleum products in different sectors of the USA (Institute for Energy Research )

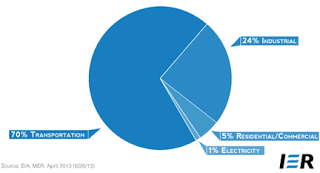

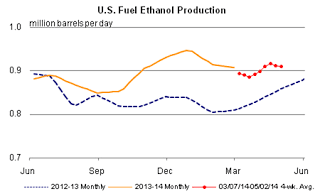

Since we are unlikely to see much change in power sources for vehicles in the next couple of years, as the oil shortage begins to bite there is insufficient flexibility in the system to offer an immediate alternative that will be viable. While corn ethanol has provided (at some cost) less than a million barrels a day it has reached an apparent plateau of production that is unlikely to change, given the alternate demand for the corn.

Figure 2. Ethanol Production in the United States (EIA) (Note: A billion gallons a year is roughly 65 kbd).

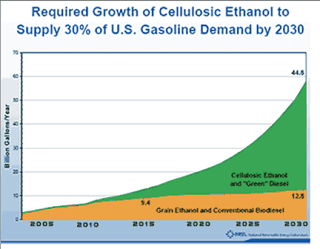

Cellulosic ethanol remains an unfulfilled promise, back in 2010 there was already some concern that it would meet even the initial targets, as time has worn on these seem increasingly out of touch.

Figure 3. Projected needs for cellulosic ethanol to meet projected national needs by 2030. (Bloomberg Biomass Magazine )

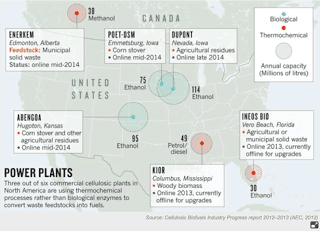

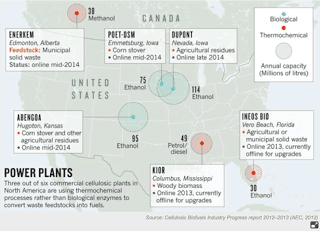

More recently Robert Rapier has noted that KiOR, one of the companies that Vinod Khosla founded and then took public as a promised source for this ethanol, is failing to live up to its promises, and may likely soon be bankrupt. It began shipments in 2013 from its Columbus, MS plant but of only nominal quantities of fuel relative to the future need. Shortly thereafter the plant shut down through the first quarter of this year, needing additional funds to improve operational efficiency.

Share prices that started at $ 15 have now dropped to $ 0.64, having recently visited $ 0.59 a share. Investments to make those changes may only come for a limited time, perhaps only through August, from Mr. Khosla. But the company has to pay back the $ 75 million it borrowed from Mississippi – with the next $ 1.8 million payment due June 30th, and there don’t appear to be other investors waiting in the wings. The state will get the assets should the company fold.

Sadly this is another exemplary case of a number of firms who promised much in this field, but have so far delivered relatively little, although there are several new plants coming on stream this year. The EPA has suggested that the production target for this year be lowered from 6 billion liters to 64 million liters – a significant cut, and one indicative of the likely difficulties in finding alternate sources to petroleum based products needed for the transportation industry when oil becomes less available.

Figure 4. Status of the Cellulosic ethanol production plants planned to be in operation by the end of this year (Nature )

The INEOS plant in Florida began production last July but then shut down and is looking to achieve stable production this year, after upgrading the facility, which will have a capacity of 8 million gallons a year. Not much against the millions of barrels a day that may be needed, but the company has the advantage that it is using local municipal waste and also providing power to the community – which provide other gains to their operations.

The Hirsch Report was published in February 2005. In that report the authors noted that it would likely take up to 20-years of concerted effort to produce an alternate source to petroleum based fuels. We are now nearly ten years through this potential period of grace, and the major candidate to provide that alternate resource is so far being found wanting.

The writing on the wall is increasingly discernable, oil companies are cutting back on exploration investment ensuring that future discoveries will likely be smaller in number as well as in size. This will reduce the amount available, requiring an alternate source. Cellulosic ethanol, which has been held up as one answer to the problem, is falling significantly short of the mark needed to make up for possible conventional shortfalls within the next decade.

The question then becomes – what is the alternative? We could look to making oil from coal, peat and other alternate sources as was done in Germany in World War 2 and in South Africa, where SASOL continues to operate. But planning, permitting, building and operating a facility to convert coal is something that will take at least seven years, and require initiatives to make commitments that are currently lacking.

What else is there? Bear in mind that solar and wind energy production largely goes to address the electricity market – which is largely separate from that of the transportation fuels. Thus their development will largely not impact the problem, since electric cars cannot be produced in the quantities that will likely be needed in the time that remains. Bedazzled by the promise of cellulosic ethanol we have failed to properly pursue the alternatives that now look as though they will prove to be needed.

Time is running short, but awareness of the problem is as yet, even less evident. Basking in the transient benefits of increased domestic production, even as turmoil has cut global oil production by an estimated 2.3 mbd, production that won’t soon return, there is less inclination to face the issue than there has been in previous Administrations, even though it is now becoming possible that it will be this Administration that first sees the impact.